Sales tax rate finder

For more information about the sales and. View Full Details Details.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Indicates required field.

. The minimum combined 2022 sales tax rate for Los Angeles California is. Get the benefit of tax research and calculation experts with Avalara AvaTax software. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

Lookup By Address. Sales Tax Rate Locator. Enter the Address City and Zip Code in the above fields to obtain the tax jurisdiction s and tax rate s for the address entered.

Please ensure the address information you. Enter your street address and city or zip code to view the sales and use tax rate information for your address. The results do not include special local taxessuch as admissions entertainment liquor.

This is the total of state county and city sales tax rates. Suite Apt Lot. Choose one of the following.

MyTax Illinois Tax Rate Finder - Online tool used to look-up by individual location either origin. What is the sales tax rate in Los Angeles California. Use this search tool to look up sales tax rates for any location in Washington.

ArcGIS Web Application - Nebraska. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. The minimum combined 2022 sales tax rate for West Covina California is 95.

Sales Tax Rates - General. Those district tax rates range from. The statewide tax rate is 725.

Sales Tax - Sales tax rate changes generally occur effective January 1 or July 1 of each year. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Viewing all rates Location Rate County.

Find Sales and Use Tax Rates. 51 rows Arizona AZ Sales Tax Rates. The Finder Streamlined Sales Tax The Finder Streamlined Sales Tax Lookup By Address ESSPRODWEB03.

This site provides streamlined sales tax information on local taxing jurisdictions and tax rates for all addresses in the State of Ohio. The state sales and use tax rate is 575 percent. This is the total of state county and city sales tax rates.

Find a Sales and Use Tax Rate. Sales and Use Tax. The California sales tax rate is currently 6.

Counties and regional transit authorities may levy additional sales and use taxes. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Ad Be the First to Know when State Tax Developments Impact Your Business or Clients.

This sales tax rate calculator is powered by the same technology used by sales tax software except that this tool does not scrub the provided address against the US Postal Service. Type an address above and click Search to find the sales and use tax rate for that location. General Rate Chart - Effective October 1 2022 through December 31 2022 2225 KB General Rate Chart - Effective July 1 2022 through September.

Comprehensive Research Platform Accurate Time-saving Tools For PlanningCompliance. Department of Revenue Sales Tax Rate Finder.

The Consumer S Guide To Sales Tax Taxjar Developers

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Calculator

Sales Tax Calculator

How To Calculate Sales Tax

Effective Tax Rate Formula Calculator Excel Template

Sales Tax Calculation Software Avalara

Effective Tax Rate Formula Calculator Excel Template

Sales Tax Calculator Apps On Google Play

How To Calculate Sales Tax In Excel

Car Tax By State Usa Manual Car Sales Tax Calculator

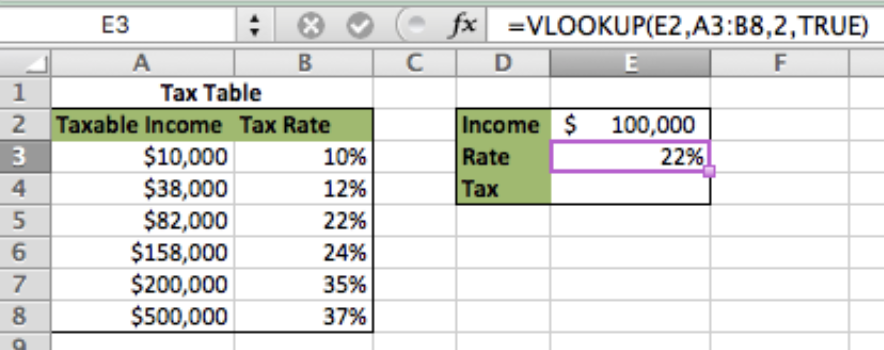

Excel Formula Basic Tax Rate Calculation With Vlookup Excelchat

Sales Tax Calculator Taxjar

Sales Tax Calculator Taxjar

Nyc Nys Transfer Tax Calculator For Sellers Hauseit